Last updated: Feb. 28, 2020

On March 26, 2020, Nova Scotia Finance and Treasury Board Minister Karen Casey presented the province’s fiscal 2020–21 budget.

The minister anticipates a surplus of $55 million for 2020–21, and a surplus of $63.2 million, $72.5 million and $74 million in the next three years.

There was a general corporate rate decrease from 16% to 14%, and no income tax or HST increases.

Our tax analysts have reviewed the budget updates and listed the highlights below.

Personal tax measures

Personal income tax rates

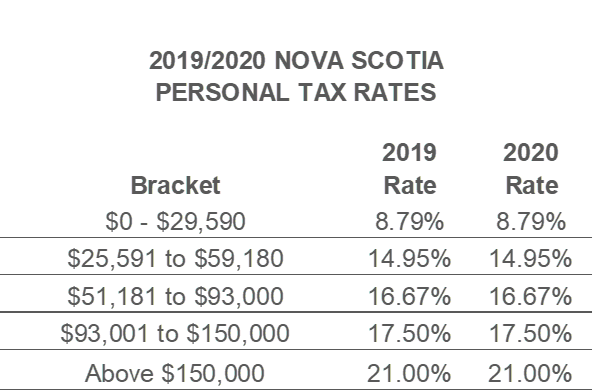

The budget does not include any changes to personal income tax rates. As a result, Nova Scotia’s personal income tax rates effective January 1, 2020 remain as follows:

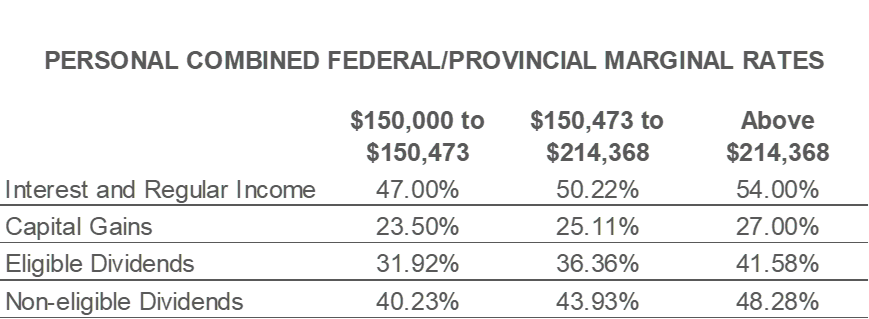

For taxable income in excess of $150,000, the 2020 combined federal-Nova Scotia personal income tax rates are as follows:

Nova Scotia Non-Refundable Tax Credits

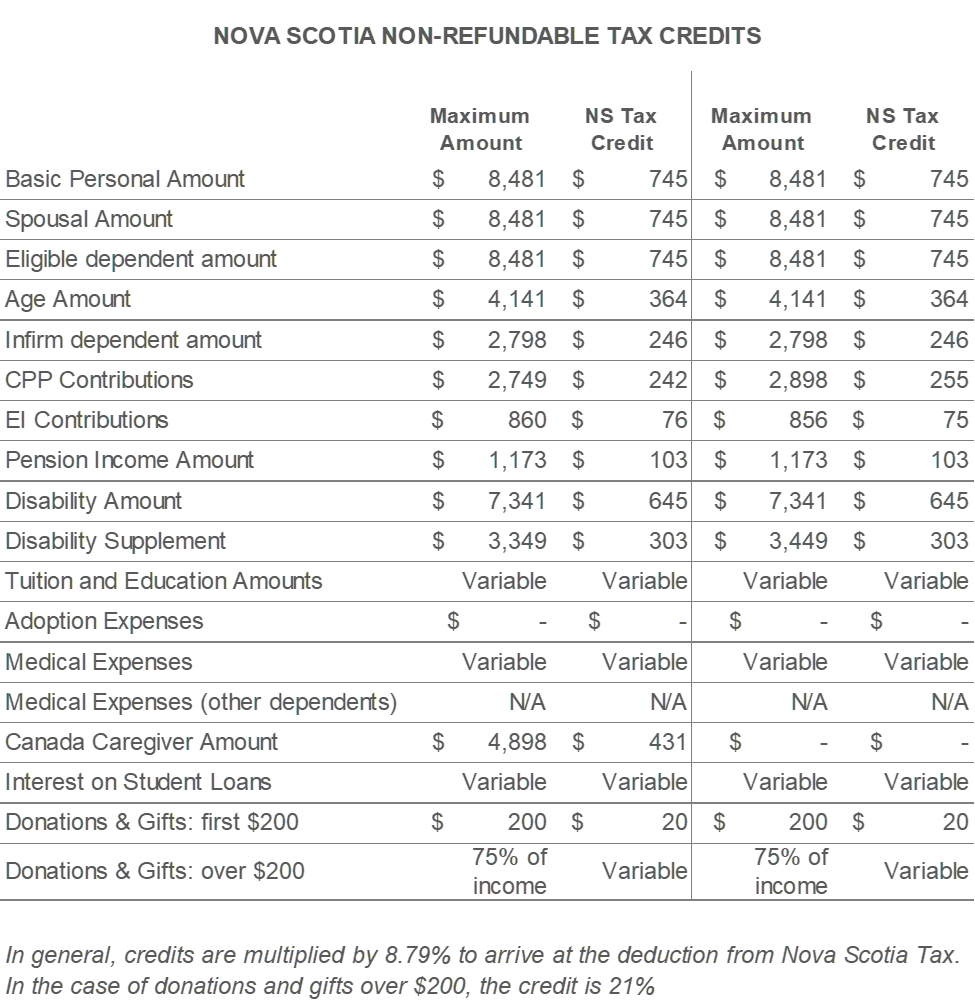

The government confirmed today that personal tax credits for 2020 will be indexed by 1.0%. The maximum tax credit amounts and actual Nova Scotia tax credits for 2019 and 2020 are set out below.

This budget proposes changes to the following personal credits/amounts:

Corporate income tax rates

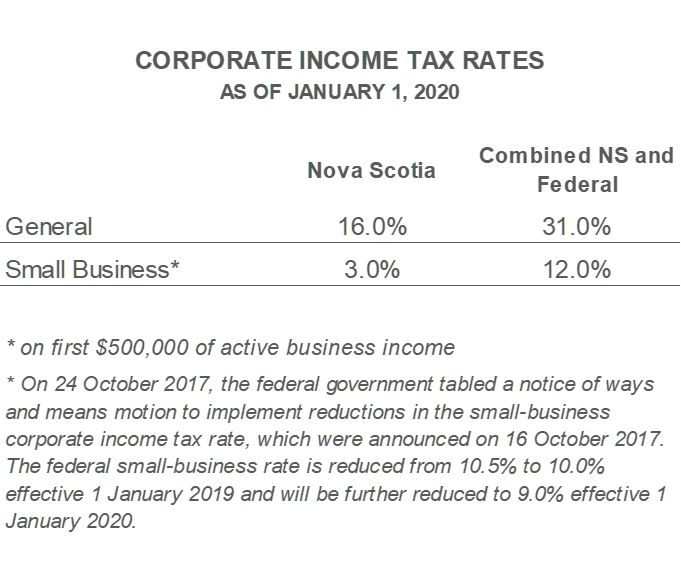

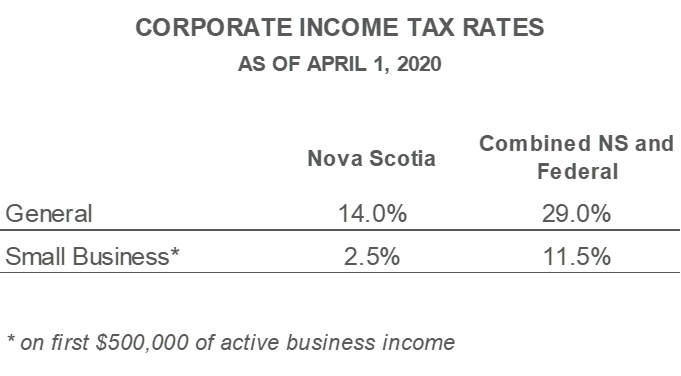

Starting April 1, 2020, the general corporate tax rate will decrease to 14% from 16%.

The small business tax rate will decrease from 3% to 2.5. No changes are proposed to the $500,000 small-business limit.

As a result, Nova Scotia’s corporate income tax rates effective January 1, 2020 remain as follows:

The minister also proposed the following business tax measures:

Digital Media Tax Credit

The Digital Media Tax Credit is extended until Dec. 31, 2025 (from the end of 2020). This refundable corporate tax credit is intended to encourage employment and foster the development of an interactive digital media industry in the province.

Digital Animation Tax Credit

The Digital Animation Tax Credit is extended until Dec. 31 2025 (from the end of June 2020). This refundable corporate tax credit is intended to support the production of digital-animation productions.

Harmonized Sales Tax (HST)

The budget does not include any changes to HST (15%).

Other budget measures

Tobacco Tax

The budget increases the tax rates on cigarettes and tobacco sticks to 29.52 cents per unit (from 27.52 cents), and on fine cut tobacco to 40 cents per gram (from 26 cents per gram).

The budget also raises the tax rate for other tobacco products to 40 cents per gram (from 18.52 cents per gram) and increases the tax on cigars to 75% of the suggested retail selling price (from 60%). These changes are effective as of Feb. 26, 2020.

Vaping Product Tax

The budget introduces a vaping product tax, effective September 15, 2020. Under this new tax, vaping substances, including those without nicotine, will be taxed at $0.50 per millilitre for liquid products, and vaping devices and their components will be taxed at 20% of their suggested retail selling price.

Disclaimer: The material above is provided for educational and informational purposes only. Always consult a tax professional like FBC regarding your specific tax situation.