Last updated: May. 19, 2023

It seems we hear about victims of fake Canada Revenue Agency (CRA) scams daily. Unfortunately, there are bad actors that take advantage of stressed out people (especially at tax time) who may not immediately recognize that they’re being scammed.

In 2022, the Canadian Anti-Fraud Centre recorded a significant increase in fraud and cybercrime reports, amounting to $530 million in losses suffered by victims. This figure represents an alarming rise of nearly 40% compared to the $380 million in losses reported in 2021.

With new and sophisticated tactics appearing every day, it’s not that uncommon for people to be duped by a tax scam and it can happen to the best of us. You need to be cautious when dealing with so-called emails, texts, or phone calls coming from the CRA.

Be vigilant in protecting your personal information if someone initiates contact with you and then asks you to verify your identity by providing them with your social insurance number, bank account information, credit card numbers, or even passport numbers. These are all scams designed to steal your money and identity.

Is it real or fake? How to spot a CRA scam

To protect yourself, it’s important to be able to distinguish communication from the CRA and that of a tax or phishing scam.

By telephone

You may receive a call from the CRA for questions about your taxes, offer support to your small business through the Liaison Officer Service, or even begin an audit.

They may ask you to verify your identify, asking for your full name, date of birth, address, or social insurance number.

The CRA will not employ high pressure tactics to get you to provide your passport number, health card, or driver’s license.

The CRA will not demand immediate payment in the form of bitcoin, prepaid credit cards, e-transfer, or gift cards from retailers like Amazon or iTunes.

On top of that, the CRA will not leave hostile voicemails or use intimidating language and threaten to send the police over to your residence and take you to jail.

If you are uncertain about the legitimacy of a call from the CRA ask the caller for a call back number to verify the call. Hang up then call the CRA (1-800-959-8281 for individuals and 1-800-959-5525 for businesses). Explain the situation. If it is a real inquiry from the CRA they will be able to verify it.

By text message or instant messenger

The only time you will receive a text message from the CRA is to verify your identity through their new multi-factor authentication process. If you have opted to verify your identity through text, you will receive a one-time passcode to access your online accounts.

This is a text message that is always initiated when you are logging into any of your online accounts. If you receive a text message at any other time, you should delete it. If it seems legitimate and you have NOT tried logging into your account, contact the CRA at 1-800-959-8281 or for businesses at 1-800-959-5525.

The CRA will not contact you through an instant messaging app such as WhatsApp or Facebook and they do not use these methods to communicate with Canadian taxpayers.

If you receive a text or instant message claiming it is from the CRA, delete it. It’s likely a phishing attempt to obtain access to your bank account or other personal information.

Here’s what a scam text message might look like (source Canada Revenue Agency):

By email

If you have registered for email correspondence and provided an email address in your CRA account, the CRA may send you an email alerting you to when a new document or notice of assessment or reassessment is ready. To access these documents you will need to sign in to your CRA account.

The CRA could also send you an email with a link to a form or publication on the CRA website. But, they will only do this if you ask for it during a phone conversation with the CRA. This is actually the only time the CRA will ever send an email with a link.

The CRA will not ask you to click on an unsolicited link or ask you to fill out an online form looking for personal or financial details and you will never receive an email with a link for you to click to get your refund.

And, like the telephone, they will never email you looking for immediate payment by e-transfer, bitcoin, or prepaid credit cards.

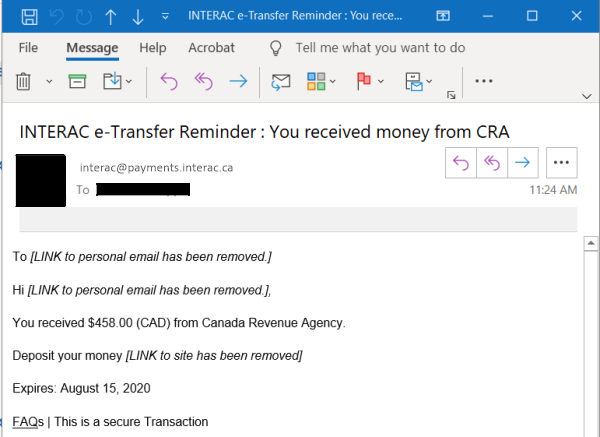

The sender may use an email address that appears to be from the CRA, Interac or a financial institution. Unfortunately, it is not uncommon to forge an email address and this is known as email spoofing.

An example of a phishing message through email would be as follows.

By mail

You could receive mail from the CRA asking you for information, such as the name of your bank. They could also send a notice of assessment or reassessment and ask you to make a payment through approved channels.

The CRA could even use the mail to initiate legal action to recover any money if you refuse to pay your taxes. Moreover, the CRA uses the mail to tell you it’s starting an audit process.

The CRA will not send you something in the mail asking you to meet up with them in person to take payment, or demand immediate payment, or threaten to take you to jail.

How to protect yourself

There are a number of ways you can protect yourself from fake CRA scams.

- Never give your personal or financial information over the Internet or by email.

- Protect your passwords, access codes, and PIN.

- Be careful of clicking on any email links. An email scam could send you to a website that looks like the official CRA site. Again, the CRA will never send a link in an email.

- Shred unwanted or unneeded documents.

- Regularly check your CRA My Account or My Business Account and sign up for email notifications of changes to your information.

- Only use a professional tax preparer and expert that you trust and always consult with them if you are unsure about communication you may receive from the CRA.

What to do if you believe you’ve been scammed

The first thing you should do is contact your local police. Provide them with as much information as possible, including copies of correspondence sent and received.

If your Social Insurance Number has been stolen, contact Service Canada at 1-866-274-6627. For more information on protecting your Social Insurance Number, go to the Service Canada website.

If you believe your login information with the CRA has been compromised, contact the CRA. If you have support in place through a professional tax consultant have them call on your behalf. Once the CRA has been notified, they will confirm if your account has been compromised and they will take action to prevent the fraudulent use of your personal information.

The government also recommends reporting the scam or scam attempt (whether or not you are a victim) to the Canadian Anti-Fraud Centre. Connect with them online or by phone at 1-888-495-8501.

About FBC

For 70 years, we have worked with tens of thousands of farm and small business owners across Canada. We optimize their tax returns, maximize their tax savings, support their financial and estate planning needs and give them the back office help they need with bookkeeping and payroll. Our corporate services including minute book filing and annual returns.

To find out more about how we can support your business, take 15 minutes to connect with us so we can get to know each other.